Author: Dr Alan Jones, PhD., C.Eng., F.I.E.T.

Executive Summary

Many readers may assume that constraining generation from a free, natural, unlimited and renewable resource such as wind would have little impact on the electricity consumer, but in practice the reverse is true. Unlike constraining fossil-fuel generation, constraining Scotland’s distributed wind fleet increases the cost to the consumer and as Great Britain (GB) transitions to Net Zero this burden on the consumer is expected to increase significantly over the next decade as more onshore and offshore wind comes on stream in Scotland.

Fixing the problem by making the GB transmission network fit for purpose, which in itself is a challenging, lengthy and expensive operation, but a Net Zero strategic priority, will also cost the consumer heavily - an estimated additional 7% on the average annual electricity bill over the next 40 years.

Laying to one side the need for a move to Net Zero this discussion paper explores the background to this interesting subject and in doing so uncovers underlying examples of market failure that contribute to poor policy decision making as well as a rising burden on electricity consumers.

1 Introduction

The subject of constraint payments made to operators of wind farms is a moot point amongst those who campaign against renewable wind proposals, particularly onshore developments. The problem is this subject has never been explored in depth so consequently campaigners usually depend on the odd newspaper article that appears from time to time quoting some enormous sum of money that has been paid out simply to shut down one or more wind farms.

The aim of this paper, therefore, is to fill the gap by peeling back – as far as is possible from information in the public domain, the story and the facts around wind farm constraints. Especially constraints affecting onshore wind power in Scotland. This way the paper will hopefully provide answers to the many questions campaigners and others ask about this subject.

A range of interesting outcomes emerge, not simply from the available data but also by manipulating the information and correlating it with other data to examine associations and infer relationships. One outcome finds evidence of market failures that may mislead communities living close to proposed wind farms on the one hand while penalising GB electricity consumers on the other, due to ill-informed policy.

The structure of the paper is laid out in a manner that first examines the growth of GB onshore and offshore wind capacity over the past decade. The energy generated from this capacity is then explored along with the efficiency, or efficacy, of the operating capacity. This is followed by an examination of Scotland’s recent supply and demand balance for electrical energy, and how and in what manner transmission constraints play a part in this picture. Penultimately, the subject of constraint payments is examined and what this means to the consumer. Conclusions complete the paper along with a set of references consulted.

2 GB Wind Capacity

Figure 1 displays the growth of onshore wind capacity in GB over the past decade. The data is taken from the Renewable Energy Foundation (REF) database and lists those wind farm installations that are monitored, outputs measured and which participate in the Balancing Mechanism [1] - more on this later. It shows how the rate of installed and operating capacity increased in Scotland after around 2015 in relation to England and Wales whose communities, unlike those in Scotland, are afforded protection in the planning and approvals process in relation to onshore wind farm proposals. Although the graph shows the growth rate in Scotland slowing around 2018 this is likely due to the earlier withdrawal of the Renewables Obligation Certificate (ROC) scheme for new wind farms, which was announced in June 2016 but rumbled along for some time with legacy systems already in the pipeline.

So, while the growth appears to have plateaued be prepared for this picture to change significantly. As National Grid’s Electricity Ten Year Statement (ETYS, 2020) makes clear, [2] by 2030 a rapid growth in Scotland’s renewable capacity is anticipated, mainly wind - to around 18,000MW (or 18GW), and this figure will go higher if offshore wind, solar, hydro and other forms of renewables are included. [3] Adding further confirmation to this aspirational growth a doubling of onshore wind has been discussed/encouraged at Scottish Government ministerial level, supporting the view that there could be at least 16GW or more of installed operational onshore capacity by 2030. And, this is against a background of Scotland having a future maximum demand (including electric vehicles and air source heat pumps) estimated at less than 6GW by 2040. [4] Imagine what Figure 1 will look like if these plans materialise by the end of decade!

Figure 1 GB Onshore Wind Operational Capacity (MW) (Source: REF)

To complete this wind power picture, Figure 2 shows the GB offshore wind capacity - currently just over 10GW, with England having the major share mainly due to shallower waters around the coastline and hence a lower cost [5] in terms of £/MWh of output.

As the UK Government makes clear in their Net Zero plans the aim is to increase offshore wind capacity to 40GW by 2030, which is an ambitious target and one that includes at least 1GW of floating offshore wind in Scottish waters. If Figure 2 were to be extrapolated over the next decade there may be over 30GW of capacity in English waters and several GW around Scotland’s east coast, with perhaps a similar amount for Wales. However, as Ambrose (2021) [6] points out, meeting this target will require one offshore turbine to be commissioned every weekday over the next decade – a challenging task!

Such practical matters, however, seem not to deter the wheels of commerce - who see only opportunity and not problems with, Thomas (2021), [7] describing how Denmark’s Orsted, Germany’s RWE and Norway’s Equinor, along with the UK’s Scottish Power and Royal Dutch Shell are some of the companies on a long list of bidders vying to build floating schemes in an auction of seabed rights for about 10GW of offshore wind projects in Scottish waters. The problem is that the LCoE for these floating platforms - suitable for deeper Scottish waters - presently costs around £190/MWh, or about 4-5 times more than onshore wind and almost twice that of nuclear. Bidders will find out in 2022 who is successful, but for the moment the UK Government’s initial ambition for around 1GW of floating wind around Scotland’s coastline feels about right.

Figure 2 GB Offshore Wind Generating Capacity (MW) (Source: REF)

The point of introducing these graphical projections is to emphasise that within the next decade, if aspirations turn into reality - and it has to if the Net Zero is to be met, then this will further amplify the existing imbalance of power flows between Scotland, and England and Wales, where the predominant demand for electricity exists. Furthermore, seasonal variation from wind power will increase the variability in the transfer of power flows as well as how the stock of generators National Grid Electricity System Operator (NGESO) can call upon is used to balance the supply and demand for electricity. This Balancing Mechanism is discussed later, but for the moment consider the following future extreme, but plausible scenarios that might be expected to arise:

- Under low wind conditions, as was experienced during the summer months of 2020 and also during the coldest day each year [8] conventional plant such as combined gas cycle (CCGT) will be ramped up - not good for CO2 emissions but it’s either that or the lights go out. Nuclear will trundle along, more or less, while interconnectors with Europe and elsewhere, [9] of which we can expect more to appear over the coming decade, will import into England. GB security of supply will be dependent on the state of the relationship with various European neighbours, and Scotland under these conditions will be wholly dependent on imports from England and Wales because by the mid-2030’s - under current plans, Scotland will have no nuclear generating plant to call upon and limited, if any, conventional fossil-fuel fired generation. [10]

- Under high wind conditions, typically during low atmospheric pressure, Scotland will be awash with wind power, as will England from offshore wind. In this instance conventional plant (gas) will be fired down, nuclear – in England, will rumble along and the excess will be exported to Europe, and as NG’s ETYS (2020) alludes, if no reinforcement of the electrical transmission boundary between Scotland and England occurs over this timeframe then significant network constraint costs will be incurred because of the increased wind generating capacity in Scotland.

National Grid, in their Network Options Assessment (NOA) 2020/21 Cost Benefit Analysis report, explore this likelihood and recommend capital investment of more than £16 billion to help manage these heavily constrained boundaries, one of the most significant of which is the Scottish - English border. [11] But, even with this future level of investment transmission system constraint costs are still forecast to rise significantly over the next decade – the same constraint costs Ofgem projected would reduce by around 2017!

3 GB Energy from Wind Generation

To complete this graphical interpretation of the data it also helps to look at the growth of electrical energy generated from the increasing wind farm capacity. Figures 3 and 4, therefore, illustrate the energy generated from onshore and offshore wind farms respectively [12] over the same timeframe.

Figure 3 GB Energy from Onshore Wind (Source: REF)

In the case of onshore wind the most noticeable observation when compared against the capacity chart in Figure 1 relates to the periods 2016 and 2020 in Scotland. In both cases it can be seen there is a significant reduction in energy output. This is renewable energy that has been lost to consumers and, as onshore wind is claimed to have the lowest LCoE it is NGESO’s preferred marginal generator it can be assumed that consumers will have had to pay a premium on their bills to source this energy from other forms of generation, typically fossil-fuel based, providing the fall in output was not linked to a fall in demand.

To this end the Covid-19 pandemic led to electricity demand in the UK reaching a record low of 330,000 GWh, down 4.6% compared to 2019. On the other hand, generation from renewable technologies recorded a 12.6% increase over 2019 - generating more electricity than fossil-fuels for the first time, [13] with wind generation up 18% to 75,400 GWh compared to the previous year. Covid-19 and falling demand for electricity in 2020 was, therefore, unconnected to wind generation, which increased - unlike gas and nuclear where both saw a reduction in output. [14]

Leaving to one side the possibility of data errors it is interesting to note that the reduction in generation from onshore wind in England and Wales correlates with that in Scotland in 2016, although to a lesser extent. This was during a period following the announcement by the UK government of the premature withdrawal of the ROC’s scheme, which may have had some impact on the commercial strategy adopted by wind farm operators. Because of the unknown factors during 2016 the reason for the fall in Scotland’s onshore generation during 2020 is chosen to analyse further and this is extended in the following Chapter, which examines the relationship between capacity and generation, and runs through Chapters 5-7.

To complete this energy picture, Figure 4 illustrates the importance of offshore wind, mainly in English waters, with a rapid capacity increase anticipated over the next decade. In this case a similar reduction in offshore generation is noted during 2016 .

fFigure 4 GB Energy from Offshore Wind (Source: REF)

4 Capacity or Load factor

With intermittent forms of renewable generation such as wind, solar and hydro it is helpful -some might say essential, for a potential investor to appreciate what return on capital expenditure (ROCE) is expected from an investment. In the case of intermittent generation, therefore, the goal over a period of time (usually 12 months) is to understand the projected relationship between actual output (usually in MWh) that may be generated during this period against the theoretical performance from a non-intermittent energy source of the same capacity. The higher the factor the better the return.

For an individual wind turbine or for a single wind farm there are a number of factors that influence the annualised load or capacity factor – henceforth referred to as the capacity factor. These include, but are not limited to, the design of the turbine in terms of hub height, blade size, design, location (higher is better), topology, maintenance and time in-service, variation in windspeed with excessive gusts causing the turbine to shut down, and constraints due to limitations on the distribution or transmission networks. However, because the analysis referred to in the previous Chapter considers the GB fleet as a whole and not individual turbines or wind farms random events or ‘outliers’ are automatically removed thereby leaving underlying causes.

Figure 5 displays these calculated relationships as mean values for the fleet of both onshore and offshore wind farms to enable a comparison to be made between a) on and offshore performance, b) England, Scotland and Wales, and c) the variation over the past 10 years.

This may appear as a ‘busy’ graph so it helps to register the fact that the solid lines represent onshore relationships while the dotted lines represent those for offshore wind.

Considering the onshore performance first, it can be seen that throughout the past decade the effectiveness of the installed capacity for all three areas of England, Scotland and Wales has both varied and shown a remarkable degree of unison in that variation, apart from 2020 when Scotland fell to around 25% while both England and Wales rose towards 30%. The possible cause for this is explore further shortly.

An investor in onshore wind, at best, therefore, might hope for an annual capacity factor, over the past decade based on a large collection of turbines - between less than 1MW to 4 MW rating and geographically disposed, of between 18-29% although the lower figure appears to be influenced by what happened in 2016, which may be the result of a special cause (a rare event).

An investor in onshore wind might also question why Scotland’s fleet of turbines fare no better than those of England and Wales, given Scotland’s general disposition for higher average annual wind speeds. One hypothesis emerges – constraints imposed on operators of wind farms in Scotland. Having said that, investors accrue higher earnings through constraint payments than they would otherwise earn through generating, which appears manifestly odd. On the other hand, such constraints appear to have prevented the Scottish Government from meeting its aim of satisfying Scotland’s gross electricity consumption from renewables by 2020, as is discussed later.

One further observation: over this time interval, as learning and experience is gained, and as turbine capacity increases, it would be usual to expect the capacity factor to increase – it might be argued from Figure 5 that this is beginning to be seen in England and Wales. But, in the case of Scotland the capacity factor is falling instead. This phenomena appears to be illogical, but is satisfied by a further hypothesis that increasing Scotland’s fleet of onshore wind farms leads to greater levels of constraint to the point where balance occurs – capacity factor will continue to fall with increasing capacity to meet the transmission capability. In this case it is expected that cumulative constraint payments will continue to increase.

The case of offshore wind presents a different picture although here, as Figure 5 shows, there is a much greater level of year-year variability - possibly indicating that operational development and learning is still occurring. Having said that, over the past 2-3 years the offshore fleet for both England and Scotland indicate an upward capacity factor trend, and it can be argued that in the case of Wales there is a similar trend. The capacity factor is some 10% or more higher than that for onshore wind, but that is expected because of the higher average wind speed [15] and the deployment of larger, and more efficient turbines. [16]

In this regard Scotland’s offshore fleet might be expected to perform better than those around the waters of England or Wales because Scotland has around 25% of Europe’s potential offshore wind and tidal resource and 40% of the UK total resource with an offshore annualised average wind speed of 9.75m/s.

Several confounding factors may be at play here, for instance: the offshore fleet in English waters operates at a larger scale and with that comes experience and developmental learning all of which may help improve operational efficiency. On the other hand, electrical energy generated offshore will add to onshore generation and together these sources will be subjected to any transmission constraint. It is possible, therefore, that Scotland’s offshore generation is being prevented from reaching full potential due to the same reason as onshore wind – a constrained transmission network.

Figure 5 Calculated Results for GB Fleet Capacity Factor (based on Renewable Energy Foundation Data)

5 Scotland – England Energy Flow

To explore the earlier hypothesis of why Scotland’s fleet of wind turbines fare no better than those of England and Wales it first helps to appreciate the flow of energy between the Scotland-England border. Figure 6, below, is based on preliminary information published by the Scottish Government [17] and extrapolated to calculate the level of conventional generation within Scotland. This is based on preliminary data and subject to alteration with successive updates, but it helps appreciate the current situation and the Scottish Government target of meeting 100% of gross electricity consumption from renewables in Scotland by 2020. It also helps draw out, in a later Chapter, the illogical and costly way this target is being pursued. It does not help that the veracity of the Scottish Government information is questionable. [18]

Figure 6 shows a total renewable generation of 31,798 GWh in 2020 from data published by the Scottish Government for onshore and offshore wind, [19] and the remainder (for hydro, solar etc.,) from Scottish Renewables.

The figure for electrical energy from conventional sources (20,148 GWh) [20] is derived by calculation [21] and generated, collectively, by Hunterston B nuclear station at 965 MW capacity – due to be decommissioned in January 2022, Torness nuclear station at 1216 MW capacity – due to be shut down in 2030, and Peterhead gas-fired station with 400 MW of remaining operational capacity.

Figure 6 Electrical Energy Balance for 2020 (Source: Preliminary information by the Scottish Government and information from Scottish Renewables)

What Figure 6 helps to illustrate is that Scotland is almost self-sufficient in renewable generation – a target it set itself to meet by 2020. Although based on preliminary information it indicates that over 97% of gross consumption came from renewable sources. Additionally, almost the same level of generation arising from conventional sources was exported, [22] although in practice any export will be a mixture from renewable and conventional generation.

What is also noticeable is the scale of the export compared to any import: 20,400 GWh vs 1,100 GWh respectively. The Scottish Government estimate the annualised value of this nett export based on an average wholesale market price of £39.38/MWh to be worth £0.75 billion. By comparison, Renewable Energy Foundation cite, based on National Grid’s Balancing Mechanism data, that the average constraint payment made to wind farm operators over the same period of 2020 was £74/MWh. In other words, operators of wind farms in the UK, on average, [23] receive almost twice the value not to generate under constraint conditions than they do to generate.

The message, therefore, is that constraints cost and these costs, or what economic theory considers to be ‘supernormal profit,’ [24] is attractive to operators due to the limited or uncompetitive nature of competition and it is passed on to the consumer without any material value being added to the service and with no additional cost to the operator. Economists describe this as a negative externality – where the consumption or production, or in this case the cessation of production of a good or service, imposes a cost on a third party that is uninvolved in the initial transaction thereby imposing a larger cost on society as a whole than on the private actors. [25]

The next Chapter tests whether and to what extent constraints are being experienced by Scotland’s onshore wind farm fleet due to transmission limitations between Scotland and England (and Wales).

6 Examining Scotland’s Constrained Energy

To test the assertion that evidence exists to demonstrate Scotland’s onshore wind is being constrained [26] reference is made to Figure 3 – showing a reduction in Scotland’s generation in 2020 vs 2019 and to Figure 5 showing likewise how the capacity factor fell for Scotland vis-a–vis England and Wales even though capacity remained at a similar level to 2019. The level of constraint is also evaluated.

The hypothesis advanced - the null hypothesis, based on the fact that for a Scotland-wide evaluation random wind farm events can be ignored, is that 2020 experienced a similar level of mean annual wind speed to that in 2019. The alternative hypothesis, if there is insufficient evidence to support the null hypothesis, is that the mean annual windspeed in 2020 was sufficiently different, and higher than in 2019, to support the argument that transmission constraints influenced the fall in capacity factor.

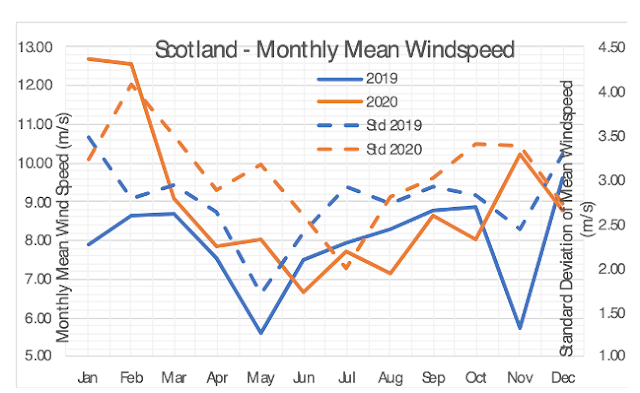

To test the null hypothesis historic daily mean wind speed data for 2019 and 2020 was obtained from an online database, Visual Crossing. From this daily data, collected and averaged from 5-minute samples taken over a number of meteorological weather stations around Scotland, mean monthly averages have also been calculated along with the standard deviation [27] of the daily mean values for each month.

Figure 7 compares the daily average wind speeds for both years in the form of a box plot. In this diagram the bold horizontal line represents the median value [28] while the width between the upper and lower surfaces of each box (in blue) represents the distribution of 50% of each set of results. The remainder are contained in the upper and lower quartiles (each containing 25% of the results) shown by the length of the single line extending from the box to the extreme value.

Two points are worthy of note. Firstly, Figure 7 shows the median for 2020 higher than for 2019 and secondly, the upper quartile for 2020 extends further than the 2019 equivalent – meaning the upper 25% of daily average results in 2020 recorded higher wind speeds than in 2019.

FFigure 7 Box Plot comparing 2019-2020 daily average wind speeds (in m/s on y axis)

Extending these observations, Figure 8 shows the results of the calculated mean monthly wind speed over 2019 (shown by the solid blue line) and 2020 (shown as a solid orange line). The equivalent standard deviation values are shown dotted and these values can be read from the secondary (right hand side) axis. Even a cursory glance here indicates that the mean monthly wind speed in 2020 was higher than in 2019 for several months with the remainder being similar. Moreover, 2020 experienced greater variability in daily wind speed than 2019.

Furthermore, statistical analysis based on a paired-sample t-Test [29] indicates that the null hypothesis of 2020 experiencing a similar level of mean annual wind speed to that of 2019 can be rejected. The alternative hypothesis of there, on average, being a difference in which 2020 average wind speed is higher (M=8.9346, SE=0.18710) than 2019 (M=7.9157, SE=0.15609) is therefore accepted. This difference in wind speed, 1.0189, BCa 95% CI [0.54936, 1.48831], [30] is significant t(364) = 4.268, p < .001

Consequently, it possible to conclude that not only was the average wind speed in 2020 higher than in 2019 there is also a significant statistical difference between the two. The conclusion, therefore, in the absence of other causes, is that Scotland’s reduced generation from onshore wind in 2020, relative to 2019, is independent of wind speed and instead due to transmission constraints limiting exports to England.

The next Chapter estimates the impact these constraints play in reducing the electrical energy generated from Scotland’s onshore fleet.

Figure 8 Comparison of Scotland’s monthly average onshore wind speed (Source: Visual Crossing)

7 Impact of Constraints on Scotland’s Onshore Generation

It is difficult to estimate the value of something that has not occurred – the loss of wind generation that has been constrained, and although National Grid report on constraint costs paid to conventional energy generators to make up the loss of renewable energy the value of the energy (in MWh’s) is not available. Renewable Energy Foundation (REF), on the other hand, place an annual figure for the amount of constrained wind energy in the public domain, but this is simply a GB-wide figure. [31] This paper seeks to test the validity of the claim made by REF and provide an estimate for the onshore wind energy constrained in Scotland.

One means of estimating constraint loss from Scotland’s onshore fleet is by making use of a mathematical model of a generic wind turbine characteristic in combination with the measured (average for Scotland) daily wind speed over the course of a year to calculate the potential theoretical level of generation yield. After subtracting other energy losses [32] the actual generation can be subtracted from the theoretical generation to provide an estimate of the energy lost due to constraints.

Several authors have undertaken studies of wind farm performance – relating wind speed and site conditions to specific models of turbines used at each site to compare theoretical levels of generation with actual generation declared to Ofgem (see Straffel and Green (2013), but few, if any, have used this technique to provide an alternative means of estimating the level of constraint.

Access to average daily wind speed has already been discussed and the missing element needed to estimate the theoretical fleet output requires some knowledge of a generic turbine power curve. [33] This characteristic typically begins at some minimum cut-in speed around 3m/s and curtails at rated speed, in the region of 15m/s, beyond which the output is constrained at 100% up to some maximum speed, usually less than 25m/s, to prevent mechanical damage to the turbine components from centrifugal forces in high winds. Between these points (3.0~15m/s) the generic characteristic has been modelled in Figure 8 using a modified cube-law expression [34] given by the equation:

Output (% of Turbine Rating) = [(Wind Speed(m/s))^3]/33.75…………….(1)

The solid blue line in Figure 9 represents equation (1) up to 15m/s, but has been modified slightly to represent a more practically realisable S-curve and it minimises the squared error between the solid line and the best-fit 6th order polynomial (shown dotted). Using the polynomial expression allows the output power to be calculated for wind speeds up to 23m/s.

Thus, the theoretical output (generation) for 2020 can be obtained by multiplying the daily mean wind speed for Scotland by the 6th order polynomial expression shown in Figure 8 and summating the results (for the resultant % output from the power curve for each day x Scotland’s wind fleet capacity of 8299MW x 24 hours) of the energy in GWh generated each day over 366 days so that an estimate can be obtained of the idealised annual level of generation from the current fleet.

This model-based estimate for the theoretical generation from Scotland’s onshore fleet yields a figure of 22,695GWh for 2020 and if this were realisable in practice it would be equivalent to a value of 31.13% [35] for the onshore capacity factor instead of the actual value of 25.1% shown in Figure 5.

Figure 9 Theoretical Model of Wind Turbine Power Characteristic

However, several practical considerations are said to account for this variation – from 31.13% to 25.1% (as detailed in footnote 27) that result, over time, in the combined generated output reducing (estimated at a fall of 12% over a 20-year lifetime) because of a constant deterioration [36] in the capacity factor.

Thus, laying to one side any annual variation of output due to changes in wind speed, the actual value of annual capacity factor, and hence the electrical energy generated in that year by the combined onshore fleet, can be estimated from the expression:

Annual Capacity Factor (%) = Theoretical Capacity Factor (%) – 0.41 x Age of Fleet ……(2)

Using equation (2) it is possible to estimate with a degree of confidence the actual generated output from each annual tranche of Scotland’s onshore installed fleet capacity given that, for instance, a 50MW wind farm commissioned 10 years ago will not generate as much energy as a similar size wind farm commissioned 5 years ago, ceteris paribus – so long as, for example, the 5-year old wind farm does not suffer an unexpected catastrophic failure.

Table 1 shows how equation (2) is implemented using data on age cited in a Scottish Renewables document on repowering [37] to provide an estimate of the output in 2020 from Scotland’s onshore fleet taking account of deteriorating output due to ageing effects.

Table 1 Ageing Effects On Scotland’s Onshore Fleet (8299MW)

Table 1 identifies the age (in years) of each batch of generating capacity and alongside is the capacity factor at that age using the -0.41 digression factor. This enables an individual calculation to be made of the output generation from each turbine age category in 2020, which is then summated to give a total value of 20,429GWh, representing a weighted average capacity factor for the entire fleet of 28.02%.

The analysis in Table 1 goes further by projecting the cumulative generation in 2021 if the capacity of the fleet remains as it was in 2020 with the same mean annual wind speed. The variable under analysis here is the marginal impact from an additional year of turbine life. In this case it can be seen there is an annual reduction in generation of around 300GWh, which is roughly equivalent to the output from a newly commissioned (operating with a capacity factor of 31.13%) 110MW wind farm. In other words, just to maintain the 2020 level of output from Scotland’s onshore fleet in 2021 – and successive years, requires one new sizeable wind farm of 110MW capacity to be commissioned every year.

Having performed the analysis, therefore, the impact from constraints can be seen from Table 1 and Table 2 - having explored and isolated the impacts from wind and ageing factors. What these tables seek to illustrate, for the latest full reporting year, is; a) the inherently low operating efficiency from an intermittent and variable source of energy. Having said that, the latest generation of 10MW+ turbines operating offshore are expected to return initial capacity factors of around 50% with equivalent 7MW and taller onshore turbines around 35%; b) how practical factors common to any rotating equipment, especially when operating in a relatively harsh environment, leads to a loss of efficiency with age. It is unlikely that such factors are taken into consideration when calculating the LCoE. An analogy would be forgetting to take account of the annual value of a depreciating asset on a balance sheet; c) asset replacement will be required on an ongoing basis to counteract the deteriorating performance of the installed base – just to stand still - and as further investment is made over the coming years to double onshore wind capacity this will add further to the burden; d) the scale of the difference, 2,146GWh, between the potential output of 20,429GWh - taking account of ageing effects, and the actual level of reported generation of 18,283GWh from onshore wind in Scotland.

As seen from Figure 6 this loss of 11.7% of actual output, had it been physically realisable, would have more than enabled Scotland to meet its 2020 target of sourcing 100% of gross electricity consumption from renewable sources.

Table 2 Comparison of Output from Scotland’s Onshore Fleet for 2020

Output (GWh) Capacity Factor (%) Comments

22,695 31.13 From turbine power model

20,429 28.02 weighted average Turbine power model including

turbine ageing effects.

18,283 25.1 Actual generation available from REF’s

database

The observation from this analysis, acknowledging the potential for errors in mathematical models, is that there is reasonable evidence to suggest an opportunity gap exists between what was theoretically generated in 2020 by Scotland’s onshore wind fleet and what was actually reported as being generated - the gap of 2,146GWh is too large to be ignored. Having considered all factors and by taking the fleet performance as a whole to be more representative of a normal distribution the first conclusion drawn is that a sizeable gap exists due to constraints on the transmission network requiring excess wind generation to be taken off-line.

To add veracity to this assertion attention is drawn to a REF database, which is believed to based on information taken from National Grid’s Balancing Mechanism trading platform. This information contains GB constraints from wind farms and shows that 3,696GWh was constrained in 2020 – a significant increase on previous years. While the constituent parts for the GB figure is not broken down it is sufficiently close to the theoretical value, taking account of ageing effects, to add confidence that 2,146GWh is in the right order to represent Scotland’s overall wind farm constraint contribution – almost 60% of the GB total.

The second conclusion that follows from this is that as Scotland’s onshore fleet is expanded – doubled – within the next decade the level of renewable energy constrained will have to increase in line with the rate of wind farm capacity expansion until a time that proposals advanced by NGESO to strengthen the North - South transmission network are implemented around the end of the decade/mid 2030, but some early relief may come if the Hunterston B nuclear station is taken out of service in 2022 as this will temporarily reduce the level of capacity feeding into the network. [38]

Extending this argument further, Figure 10 illustrates graphically how the level of wind farm constraint has risen each year (as a % of the GB total onshore and offshore wind generation) and how the rate has increased sharply since 2019. The observation emerging from Figure 10 is that over 6%, and rising – of renewable wind energy is being lost simply because the transmission system is inadequate at present to convey this potential resource south to where demand exists. [39]

Because the consumer pays, unwittingly perhaps, through their electricity bill for the privilege of being denied access to this valuable renewable resource the remaining conclusion that further wind development should be halted until there is a change to facilitate the transmission requirements from Scotland’s burgeoning renewable capability seems an obvious one to draw.

An alternative and cheaper option would to site any further onshore wind closer to the centres of demand, as is being done with offshore wind in English waters. Such a move would also help reduce North – South transmission losses, estimated to be around 4%. A yet further, but costly, option would be for each new wind farm development proposal to include battery storage of sufficient size (MW) and capacity (MWh) to ensure, probabilistically, that the additional renewable generation does not increase the existing level of constrained energy.

The next Chapter examines constraint payments and the implications going forward.

Figure 10 Showing Rising Levels of GB Constrained Wind Power (Source: REF)

8 Wind Farm Constraint Payments

Before discussing constraint payments themselves it is first necessary to put into context the trading arrangements for electricity, because electricity can’t be traded like a ‘normal’ commodity – once electricity is delivered onto the transmission system in real-time by generators it is consumed indiscriminately by demand. In other words, the generation goes where the system needs it to go rather than directly to, and only to, the customer of the supplier that contracted for it. [40] Hence, for example, it is a fallacy to purchase ‘green electricity’ in the belief that as a consumer 100% ‘green electricity’ is being delivered to one’s home or business.

The electricity market is, therefore, more complex because it can’t be stored in bulk and it must be generated, delivered and consumed instantaneously and continuously in real time - generation and demand must match each other at all times. To make matters even more difficult it is not metered in real-time so delivery and demand via metered volumes must be identified after the event. Furthermore, demand is not fixed ahead of time – it is dynamic and depends on many factors such as the weather, season, time of day and, for example, what is on TV. Consequently there can be errors between predicted and actual demand. There may also be transmission constraints that prevent generation from one area meeting demand in another area.

The task of balancing delivery (generation) with demand in GB - effectively real-time management, is undertaken by NGESO through what is known as a Balancing Mechanism that divides each 24hr period into half hour chunks called Settlement Periods.

For each period the supplier demanding electricity assesses in advance what their demand will be and a contract is struck with a generator for that volume, and in that half hour period the generator is expected to deliver the contracted volume of electricity. In practice, however, plans can go wrong. For instance, suppliers may forecast incorrectly, a generator may not be able to generate the contracted volume or a transmission constraint may prevent generation from reaching the consumer.

NGESO manages this complex balancing process - keeping the lights on, through a series of bids and offers [41] by contracting with generators that have additional capacity and who are prepared to make the additional volume available at a price they wish to receive or, alternatively, with generators who are prepared to reduce the volume being generated and who can set a price for such a reduction. A similar arrangement exists for suppliers flexible enough to be able to reduce or increase demand.

Overseeing the commercial aspects of this balancing (and trading) mechanism is Elexon, a private, not-for-profit business owned by NG that oversees the processes that settle payments between generators, suppliers and traders. [42] It compares the amount of electricity that generators say they will produce and how much suppliers say will be consumed in each half hour period while also working out the price difference and overseeing the transfer of funds between all parties.

In the case of a bid from a generator to reduce output because more electricity is being generated in a region than is required to meet the demand in that region and a transmission constraint exists preventing the excess electricity being exported to a region where demand exists then the bid price submitted to NGESO is fundamentally different for a conventional generator to that of a wind generator participating in the Balancing Mechanism. In this case if a fossil-fuel generator, such as a gas-fired power station, agrees to reduce output then as a fuel saving will be made by the generator the operator will submit a negative bid to NGESO reflecting the variable cost saving.

With a wind farm operator a different situation applies. Although a wind farm has no variable fuel cost – the energy, wind, is free at source, the operator will seek to recover any loss associated with the Renewable Obligation scheme and will, therefore, submit a positive bid. And, because this is a market in which participants seek to make money from participating in the Balance Mechanism bid prices have in the past, and still do, exceed the value of the subsidies foregone – although significantly more so in the past. [43]

A number of players, including REF, [44] responded to an Ofgem consultation on the future of transmission constraints and the licence conditions with REF pointing out the historical, excessive price of bids by onshore wind farm operators. REF gives examples; one of which reflected the average price paid to Scottish wind farms in 2011 under this bid process at £220/MWh whereas the lost subsidy was only £55/MWh. More recently these supernormal profit opportunities have reduced but even as recently as 2020 the average GB wind farm constraint payment was £74/MWh with the highest monthly average figure of £92/MWh. Of course, daily and half-hour bids will be even higher as the process of averaging tend to reduce the peaks.

At this stage the reader may be tempted to ask why, if fossil-fuel generators submit negative bids are they not invited to reduce generation, in the case of a constraint, so as to save the additional cost burden that ultimately falls upon the consumer? The answer is that constraints usually occur during periods of high wind when wind farms are making a significant contribution to the energy mix and as onshore wind has the lowest marginal cost of generation (in £/MWh) fossil-fuel generators will have already bid to reduce output before any constraint is reached. Nuclear rarely features in these type of bids because of the base load nature of nuclear generation.

To demonstrate the significance of constraint payments made under the Balancing Mechanism data from both the REF the NG Monthly Balancing Services Summary Report [45] has been compared. These data are shown for the years 2012 – 2020 in Figure 11. There is a difference and there should not to be as both are supposedly derived from the same source. One possibility explanation is that reporting for the NG Balancing Mechanism runs from 1 April – 31 March each year while REF figures run from 1 January – 31 December. On the other hand, summating the long-run constraint payments between 2012-2020 shows REF under-report the cumulative payments by almost £100 million over this period compared to NG.

What should not be ignored from this discussion – as it is not included in Figure 11, is that when a generator, such as a wind farm, is requested to reduce or constrain the amount of electricity it is producing the electricity it was producing is still needed to balance the system. Consequently, NGESO needs to accept offers from other generators, almost always based on flexible Combined Cycle Gas Turbine (CCGT) power stations south of the constraint, to make up the shortfall. This too has an associated additional cost that is also carried by the consumer. [46]

The corollary here is that while the total payment to operators of GB wind farms via the Balancing Mechanism was £244.7 million [47] from 1 April 2020 – 31 March 2021, of which £224.15 million was associated with managing constraints, payments to other generators to make up the shortfall was only £5.11 million. This huge 44:1 reduction in cost to replace the same quantity of energy by typically – gas, is yet another example of market failure. A market distorted by subsidies.

Figure 11 Showing the scale of Constraint Payments made to GB Wind Farms

The rising trend in these payments, a significant proportion of which arise in Scotland from onshore wind, flies in the face of Ofgem’s decision [48] on the Transmission Constraint Licence Condition prohibiting potential abuse by generating licence holders and other stakeholders. In their decision letter Ofgem makes clear to potential abusers that periods of high transmission constraints were expected to reduce around 2017 following improvements in the transmission infrastructure. In other words, this was meant as a warning to deter excessive pricing behaviour, but it is clear from Figure 11 that it has not had the desired impact and, at first sight, it appears that transmission constraint pricing behaviour by generators has become even worse in recent years.

Figure 12 offers an alternative and potentially more plausible explanation. While it has to be remembered that correlation does not imply causation, what Figure 12 illustrates is the relationship, or association, between the growth of GB wind farm capacity (the cumulative MW rating) and the increase in constraint payments over time, between 2012 to 2020.

While there appears to be two outliers (23GW, £244-270 million), in practice the results from both REF and NGESO for 2020 reflect the increasing rise in constraint payments over the past year in relation to previous years. Hence, while they may appear as outliers if this rate of rise continues in future years then these results will no longer appear exceptional. And, there is every reason to believe, over the next decade, that a new, increasing trendline will emerge because of the Scottish Government’s stated ambition for a doubling of onshore wind together with increased offshore wind.

With no measures in place to upgrade the transmission network until 2027, and beyond, to instal and commission four new East Coast sub-sea HVDC links between Scotland and England the situation looks dire for increasing constraint payments. Even NGESO, in their NOA (2020/21) report, share their concern for a future constraint scenario impacted by large increases in renewable generation, particularly in the North (onshore wind in Scotland) and East (offshore wind in England) of Great Britain:

“…Even with the NOA’s substantial investment recommendations, constraint costs are still forecast to rise significantly over the next decade…”

Figure 12 Correlation between GB Wind Farm Capacity and Constraint Payments

Figure 12, therefore, is indicative of historical performance over the period 2012-2020 where for every single additional GW of wind power capacity added to Scotland fleet the cost of annual constraint payments shows an associated increase of £14.7 million on the previous year. This figure, based on the likely slope of the trendline beyond 2020 is expected to increase over the next decade until transmission constraints begin to ease following investment in large capital projects.

This Chapter has explored the association between renewable wind capacity and constraint payments given the present limited power capacity of the transmission network to transmit excess energy to where demand exists. The questions that begs an answer is, why add yet more capacity – a doubling in the case of Scotland, to an already constrained network when there can be only one outcome: more constrained renewable energy together with added cost to consumers?

9 Paying the Cost of Wind Farm Constraints

As this discussion paper has sought to highlight – transmission constraints have a direct impact on electricity consumers through higher bills arising from annual transmission constraint charges as well as from the recovery of capital expenditure needed to ease constraints. The former – net £229.27 million in 2020/21, [49] arises from bids paid to developers, generators or stakeholders via the Balancing Mechanism to reduce generation including additional costs through offers by fossil-fuel generators to make up the lost capacity. The latter, in the form of capital expenditure to abate transmission constraints over the longer term, is estimated by NGESO as being in the order of £16 billion, of which the major share is allocated to address the North – South boundary issue. [50]

GB electricity consumers (bill payers) estimated from the number of occupied dwellings, all 26 million of them, [51] are expected to pay for these excess charges as the transmission operator will seek to recover any capital cost over the depreciation of the asset value needed to abate the constraints while NGESO will aim to recover any annual constraint charges paid to generators as part of the consumer tariff and recovered from the energy supplier.

In order to normalise the expenditure for constraints as well as to annualise capital spend use has been made of a MS Excel function, PMT, which is a financial function that returns periodic payments for a loan based on constant interest rate and constant payments. In this evaluation the depreciation term has been set to 40 years and the interest rate or cost of capital at 3.5% - not far from Ofgem’s advice to transmission operators. The present value is set to £16 billion and annual interest payments made at the year-end with assets written-off at the end of the term.

From this simple exercise, based on the unlikely scenario of low interest rates remaining fixed for 40 years, Excel returns a value of £750 million in annual interest charge over the depreciation period in order to recover the capital outlay. If this figure is added to the £229.27 million for constraint charges a total annual figure of £979.27 million needs to be recovered from consumers each year. This is equivalent to almost £38 that will be added to consumer bills to abate these transmission constraints once the capital projects are sanctioned, the work completed and paid for. This charge, if implemented fully in 2020, would have increased the average electricity consumer bill by almost 7.0%. [52]

Emerging from this analysis is further evidence of market failure – on this occasion arising from information failure, [53] which, if true, is disappointing given the rise of consumer awareness in recent times for the increasing cost of energy in general and electricity in particular. In this case government, transmission operators and those operating wind farms have all failed to make consumers aware of the facts in relation to the impact from transmission constraints. Some of the more obvious failures arise as follows:

a) that Scotland’s intermittent wind capacity can give rise to power constraints on the transmission network between Scotland to England during periods of high wind thereby curtailing transmission to where demand exists for the excess energy.

b) that the renewable energy curtailed has to be satisfied by alternative fossil-fuel generation south of the constraint.

c) that the cost of make-up energy supplied by fossil-fuel generators is many times less than the cost of the wind energy foregone.

d) that the level of energy constrained has increased over recent years in line with Scotland’s increasing onshore wind capacity.

e) that the level of constraint will increase still further, and perhaps significantly so, as aspirations for a doubling of onshore wind and increased offshore wind materialise over the next decade.

f) that action to manage these constraints is already impacting the consumer via an additional charge on their bills.

g) that further and potentially larger additional charges will need to be paid for by consumers in order to help ease these constraints.

But, perhaps the most significant and over-arching example of information failure lies with the fact that the currently accepted method for evaluating the life-cycle cost of electricity generation – known as the levelised cost of electricity, takes no account of, nor seeks to even acknowledge any of the additional costs associated with wind power. In this case the majority of consumers, even discerning one’s and those considered knowledgeable are likely to be ignorant of the potential additional cost burden that can arise from this form of renewable energy. Their support for this form of technology may, therefore, be misplaced.

Even Scotland’s First Minister, Nicola Sturgeon, MSP, has fallen foul of this information failure, claiming - according to Crichton (2021), in response to a question by Anas Sarwar, MSP, that further nuclear generation in Scotland will cost consumers an additional £40 each year while equivalent offshore wind farm generation will reduce consumer bills by £8 a year. What she was referring to here, perhaps in error, was the LCoE, which ignores the cost of connecting the wind farm to the transmission and distribution networks and hence to the consumer. In other words, the LCoE simply reflects the cost of building, commissioning, operating, maintaining and eventually removing a stranded asset. Had she cited the enhanced levelled cost for offshore wind her comments would have been different, and higher. [54]

To be fair to the range of actors mentioned above, this form of market failure may be due to a set of unintended consequences arising for a variety of reasons; such as the change in planning law in England and Wales that has had the effect of almost exclusively driving onshore wind into Scotland, thereby ensuring that this technology becomes truly distributed in the sense that it is often remote from centres of demand - thereby incurring higher transmission losses along with the necessary infrastructure depleting the value of the natural capital of the host. On top of this lies the unpredictable, intermittent and variable nature of wind power in relation to the present scale and type of conventional generation in Scotland [55] along with the limited capacity of the high voltage transmission system linking Scotland to England (and Wales, with the HVDC Western Link subsea cable), which means that there will be times in the year when wind will need to be constrained to ensure integrity of the system leaving consumers to pay an excessive price for the renewable electricity foregone.

Perhaps, therefore, during the early days of onshore wind in Scotland and the euphoria surrounding the ambition for more and more renewable, ‘free’ generation – to reach the point of self-sufficiency, these actors may have collectively failed to recognise the inherent limitations of the system used for evaluating the cost of electricity. That what is needed to provide a complete picture is a holistic approach that reflects the total cost to society at the point of delivery - not just at the point of generation, and not only for wind, but for other forms of generation as opportunities for market failure exist here too. [56] Use of the metric, the ‘enhance levelised cost,’ would be a good starting point to help level the playing field.

10 Conclusions

This discussion paper has examined the subject of wind farm constraints in some depth and in doing so several observations have emerged and assertions made, backed up in one case by hypothesis testing. A number of specific conclusions are highlighted to bring the discussion to a close with the hope that the reader with an interest in this subject will be better informed.

Before introducing the specific conclusions, however, two points need to be made: firstly, this paper has not been written with a view to denigrating wind power in general or onshore wind in particular. Indeed, recognition is made here to the important - essential role this form of generation has and will continue to play in decarbonising the power generating industry and thereby helping mitigate climate change.

The second point is an overarching conclusion, and that is that while it is accepted that onshore wind is the cheapest form of electricity generation based on the LCoE life-cycle calculation this methodology fails to account for the more wider and substantial costs, both in financial and human terms, arising from the integration of a distributed, and intermittent energy source into the GB-wide generation mix. These costs, that ultimately fall upon the shoulders of consumers and the communities in which these wind farms and associated infrastructure are located will not be fully appreciated until a more holistic measure is introduced. Moving to the use of the term, ’enhanced levelised cost’ as a means by which to include some of these wider system impacts would be a useful first step.

The specific conclusions are as follows:

1 It is likely that Scotland will have up to around 40GW of renewable electricity generating capacity by 2030-35 of which 16-18GW could come from onshore wind – almost doubling the current installed capacity of onshore metered installations. Without adequate co-located peak lopping [57] or storage capability this rapid expansion of wind generation will lead to significantly greater constraints together with higher consumer bills.

2 The strategic move to renewables from the previous centralised form of generation, based on conventional generating sources sited near towns and cities, to the rapid expansion of distributed and often remote onshore wind generation in Scotland has exposed a key weakness in the strategy – getting the renewable energy to where the demand exists, especially during periods of high wind.

3 Due to this weakness the practice of constraining renewable energy has been increasing in Scotland for some years, with every GW added to Scotland’s fleet of onshore wind capacity costing more in constraint charges - around an additional £15 million year on year and increasing; totalling almost £250 million in 2020, and recovered from consumers.

4 Locating future onshore wind installations where demand exists, in suitable sites in England and Wales, is unlikely to gain approval even though it is an obvious remedy to both minimising constraints as well as transmission losses.

5 The lack of a comprehensive approach to a GB-wide energy policy places development-led wind generating capacity ahead of the ability to move excess energy from Scotland to where demand exists – it will take the next decade and beyond to fix these transmission constraints at a cost to the consumer of around £30 billion over the next 40 years.

6 Government incentives together with electricity trading via the Balancing Mechanism serve to distort the market and introduce market failures – allowing developers and others to earn supernormal profits during periods of constraint while information failures disguise the true cost of wind power.

7 Maintaining Scotland’s onshore wind energy generation at the present level in the presence of turbine ageing factors will require continuous annual capital investment in new wind farm capacity – costing the consumer around £150 million over the next 25 years.

8 Replacing Hunterston and/or Torness nuclear stations with equivalent fossil-fuel generation (CCGT) provides the GB transmission network with greater flexibility to balance supply and demand during periods of high wind output – reducing constraints and allowing Scotland to better able to satisfy its aim of meeting 100% of gross electricity consumption from renewables without the need for more onshore or offshore wind, although the trade-off would mean eliminating low-carbon electricity from nuclear against more carbon emission from gas.

11 Endnotes

[1] Approximately 1/3 of the total GB onshore wind capacity is embedded in distribution networks rather than connected directly to grid supply points. Consequently, only around 2/3 of total capacity is monitored directly while the largely unmonitored embedded remainder is indistinguishable to the Electricity Supply Operator (ESO) and serves to make it appear as if the load on the network has reduced.

[2] Under the chapter, Regional Drivers.

[3] Various actors report cumulative figures as high as 38GW by 2035.

[4] National Grid’s ETYS (2020).

[5] Known as the Levelised Cost of Electricity or abbreviated to LCoE. The Levelised Cost of Electricity (LCOE) is the discounted lifetime cost of building and operating a generation asset, expressed as a cost per unit of electricity generated (£/MWh). It covers all relevant costs faced by the generator, including pre-development, capital, operating, fuel and financing costs. This is sometimes called a life-cycle cost, which emphasises the “cradle to grave” aspect of the definition.

The levelised cost of a generation technology is the ratio of the total costs of a generic plant to the total amount of electricity expected to be generated over the plant’s lifetime. Both are expressed in net present value terms. This means that future costs and outputs are discounted, when compared to costs and outputs today. The main intention of a levelised cost metric is to provide a simple “rule of thumb” comparison between different types of generating technologies. However, the simplicity of this metric means some relevant issues are not considered.

[6] The Guardian, 4 September 2021, "Gone with the wind: why UK firms could miss out on the offshore boom."

[7] The Financial Times, 2 August 2021, “UK pushes floating wind farms in drive to meet climate targets”

[8] The day usually coinciding with the maximum demand for electricity.

[9]Presently 10GW of operational interconnectors with the latest, to Norway at 750km in length, coming into operation recently. A further 4 sub-sea interconnectors at a combined rating of 3.5GW capacity are presently under construction while a further 30GW are at some stage of planning. Source: IET Webinar, HVDC Interconnectors a case study of a 2000MW scheme presented by Dr Norman MacLeod, 12 October 2021.

[10] There is no certainty that Peterhead will continue operation in the future – that depends on commercial factors as well as political sentiment.

[11] And within Scotland too, as all the Scottish boundaries as defined by NGESO will be subject to some form of constraint, mainly thermal, because of the rise in onshore and offshore wind.

[12] Shown in GWh in this case because of the scale of the units.

[13] Renewable sources generated 134,600 GWh in 2020 compared to 117,800 GWh from fossil-fuel, which is the first time this has happened since the UK Government published their time series on electricity.

[14] Generation from gas was down 16% in 2020 compared to 2019 while nuclear was down 11% due to a series of statutory and unplanned outages.

[15] Scottish Government (2011) Scotland’s Marine Atlas: Information for the National Marine Plan and Global Wind Atlas at https://globalwindatlas.info/ which shows average annual wind speed around Scotland’s coastline at a height exceeding 100m of in excess of 9.0m/s. Equinor cite an annualised mean speed of 9.75m/s.

[16] Renewables UK Statistics section states, citing BEIS, average capacity factors for UK onshore windfarms as 26.62% and offshore as 38.86% over the period 2015-2019, with the latest offshore platforms achieving 58.4%. Equinor (https://equinor.ft.com) provides figures for current offshore turbine ratings as 8-10MW and advise that the 3.6GW Dogger Bank windfarm, some 175km East of Tyneside, will be the first in the world to use 13MW and 14MW turbines with blade sweep diameter of 230m. Due to scale and efficacy Equinor cite the cost of Dogger Bank falling to £41-61/MWh in comparison to the present cost for offshore wind at £84/MWh and for wind turbines on floating platforms at around £190/MWh.

[17] Scottish Government (2021) Energy Statistics for Scotland, Q1, 2021 Figures 2020.

[18] The earlier report, June 2020 Energy Statistics for Scotland calculates an incorrect figure on Page 3 for the 2019 average daily electricity demand and on a later page it refers to the 2.0 GW of projects under construction, most of which are onshore wind farms off the Moray Firth. It appears as though the report has been published without being checked for accuracy.

[19] It appears that the generation published by the Scottish Government in their Q4 2020 report for onshore and offshore generation (of 22,576 GWh) (Source: https://www.gov.scot/binaries/content/documents/govscot/publications/statistics/2018/10/quarterly-energy-statistics-bulletins/documents/energy-statistics-summary---march-2021/energy-statistics-summary---march-2021/govscot:document/Scotland+Energy+Statistics+Q4+2020.pdf) is simply derived from the installed capacity of each source multiplied by the annual hours and the average UK capacity factors for 2015-2019 published by BEIS (26.62% for onshore and 38.86% for offshore) and cited by Scottish Renewables rather being based on actual measurements. The figures for 2020 published on the Renewable Energy Foundation website for Scotland’s combined onshore and offshore generation is 21,584 GWh by comparison.

[20] This derived figure of 20,148 GWh for conventional generation appears high because if all three stations were available to operate at full capacity for a whole year the amount generated would be 22,642 GWh, which further suggests the figures released by the Scottish Government are in need of revision.

[21]As Gross Electricity Consumption is equal to the total electricity generated minus net exports then the value of generation from conventional sources can be estimated given the availability of the other variables.

[22] The export element should make reference to Wales via the HVDC Western Link.

[23] The Balancing Mechanism trading platform works on 30 minute trading periods for bids and offers for electrical energy. Hence, this short term trading has more volatility than the 12-month average. For example, the monthly average for 2020 varied from £68-92/MWh with a mean of £74/MWh and hence the daily and 30 minute trades will increase the volatility of prices that are bid/offered and accepted.

[24] If a firm makes more than normal profit it is called supernormal profit. Supernormal profit is also called economic profit and abnormal profit, and is earned when total revenue is greater than the total costs. Total costs include a reward to all the factors, including normal profit. This means that, when total revenue equals total cost, the entrepreneur is earning normal profit, which is the minimum reward that keeps the entrepreneur providing their skill, and taking risks. However, the level of supernormal profits available to a firm is largely determined by the level of competition in a market – the more competition the less chance there is to earn supernormal profits. Consequently, supernormal profit can be derived in three general cases: !) By firms in perfectly competitive markets in the short run, before new entrants have eroded their profits down to a normal level. 2) By firms in less than competitive markets, like firms operating under monopolistic competition and competitive oligopolies, by innovating or reducing costs, and earning head start profits. These will eventually be eroded away, providing further incentive to innovate and become more cost efficient. 3) By firms in highly uncompetitive markets, like collusive oligopolies and monopolies, who can erect barriers to entry protect themselves from competition in the long run and earn persistent above normal profits. (Source: www.economicsonline.co.uk)

[25] HM Treasury (2020) Net Zero Review publishes initial analysis of green transition, 17 December 2020.

[26] Gill and Bell (2017) provide a summary of the reasons why constraints occur when operating a power system. These reasons include: 1) the thermal rating of one or more components is exceeded leading, in the case of overhead lines, to excessive sag 2) excessive voltage variation overstressing network equipment or users apparatus 3) the ability to maintain system frequency close to 50Hz 4) the possibility of power flows causing system instability 5) a disturbance that could cause the system voltage to collapse 6) fault conditions due to a system short circuit that does not have the correct protection/discrimination. See: https://www.climatexchange.org.uk/media/2057/cxc_energy_security_full_report.pdf

[27] The standard deviation is a useful mathematical value as it denotes the amount of variation around the mean. In other words, while not mathematically precise, it gives an indication of the variability of the wind speed in this case. For a more precise measure the variance should be used, which is calculated from the standard deviation squared.

[28] The median is the middle score of a set of ordered observations.

[29] A paired sample t-test can be used to compare the means from the same group at different times to determine if the mean difference between pairs of observations is significantly different from zero.

[30] On average the mean daily windspeed in 2020 was 1.0189m/s higher than in 2019. There is also a 95% confidence level that the true difference between 2020 and 2019 daily wind speed lies between 0.54936 to 1.48831m/s.

[31] At least for non-fee paying subscribers to their database.

[32] Staffel and Green (2013) provide a useful summary of the main cause of losses from a wind turbine. Three that are well understood include: 1) machine availability 2) operational efficiency and 3) wake effects (interactions between neighbouring turbines due to increased turbulence and reduced wind speed. A further two are less well understood and these include 4) turbine ageing and 5) site conditions. For a full explanation see Staffel, I. and Green, R. (2013) how does wind farm performance decline with age? http://dx.doi.org/10.1016/j.renene.2013.10.041

[33] See RWE and Sohoni, Gupta and Nema (2016) in references

[34] The expression for the power available from a wind turbine is given by P (available) = ½(pAv3Cp) where p=air density (kg/m3), A= swept area of blades (m2), v= wind speed (m/s) and Cp is a power coefficient unique to each turbine but based on the Betz limit of 0.59. Consequently, in practice Cp will always be less that 0.59 and could be much lower. In this model-based analysis, and because the Scottish fleet is taken as a whole, at 8299MW rated capacity, Cp can be ignored.

[35] This theoretical or ideal value for the capacity factor for 2020 (a leap year) is calculated from the equation CF(%) = 22,695,000MWh x 100/(8,299MW X 8,784hrs).

[36] Staffell and Green (2013) are able, by using fixed effects from the regression of observed capacity factors for the UK fleet against ideal capacity factors estimate a linear annual fit of -0.41 points after the first year of operation.

[37] Scottish Renewables (2018) Consultation response on assessing the impact of repowering wind farms on nature. https://www.scottishrenewables.com/assets/000/000/065/SR_response_-_SNH_2018_repowering_guidance_-_final_original.pdf?1553086761

[38] NGESO ETYS (2020, p.25) as well as Gill and Bell (2017) mention that while the present South-North transfer capacity is enough to meet maximum demand in Scotland it will still be necessary for sufficient conventional synchronous generation to remain in service in Scotland to maintain year-round system operation. Thus, when nuclear is taken out of service and if Peterhead closes then an alternative conventional fossil-fuel generating station will be required to replace these assets.

[39] Strictly, some constraints will give rise outside Scotland, but it is estimated from REF’s constraint data and the theoretical value of Scotland’s constraint in 2020 that at least around 2/3 occurs within Scotland’s boundary.

[40] See Elexon (2019) The Electricity Trading Arrangements.

[41] A bid is a proposal to reduce generation or increase demand while an offer is a proposal to increase generation or reduce demand.

[42] A trader doesn’t have any generation to sell or any customer’s demand to satisfy and therefore trades a volume of electricity for profit.

[43] See REF document, Notes on Wind Farm Constraint Payments (undated).

[44] REF (2016) Response to the Ofgem consultation on the future of the Transmission Constraint Licence Condition.

[45] NG Monthly Balancing Service Summary 2020/21

[46] NGESO (2021) Monthly Balancing Service Summary 2020/21.

[47] This figure includes payment for resolving frequency management issues or creating flexibility across the GB generation portfolio as well as the net payment to wind farm operators to manage constraints.

[48] Ofgem (2017) Decision to introduce the Transmission Constraint Licence Condition (TCLC) as a standard Licence condition prohibiting potential abuse of transmission constraints, 17 May, 2017.

[49] This issue of constraints and associated constraint costs to balance the system (undertaken through the Balancing Mechanism) is complex and is therefore outlined in the NGESO Monthly Balancing Services Summary document. Even so it is still complex to interpret – the key feature being the use of market arrangements to manage a range of issues, from Black Start, Short Term Operating Reserve etc. through to Constraints. But, even with Constraints dealt with under the Balancing Mechanism, these can be classified into Transmission Constraints, Voltage Constraints and Rate of Change of Frequency Constraints. The interest in this discussion paper lies in Transmission Constraints, which for 2020/21 (up until 31 March 21) incurred costs of £534.6 million of which £244.7 million was paid to operators of GB wind farms.

[50] Not all of this North-South boundary issue is related to the Scotland-England boundary, or B6-NGET as it is known. There are several boundaries within Scotland B0-Upper North SHE Transmission, B1A-NW SHE Transmission, B2-North to South SHE Transmission and so on. All these boundaries have thermal constraints and with increasing onshore and offshore wind these boundaries will require capital expenditure to help lessen any constraint.

[51] National Statistics; Dwelling stock estimates: 31 March 2020, England shows 24.7m dwellings of which 2.7m are vacant. For Scotland, Housing statistics for Scotland 2019 shows 2.6m at www.housingnet.co.uk while for Wales see https://statswales.gov.wales which give a figure of 1.438m at 31 March 2020. Total stock of 28.838m of which 2.7m are vacant in England. For this exercise assume 10% are vacant which leave almost 26m occupied and called up to pay for electricity.

[52] See statistica.com, Average annual domestic electricity bill in the UK, showing for 2020 a figure of £569. Thus, an increase of £38/year represents 6.62% although as capital expenditure will not be expended until later this decade and as the average domestic future electricity bill cannot be projected the calculation has assumed, for simplicity, that the capital expenditure has been incurred in order to aid the calculation.

[53] This is a type of statistic non-price failure which occurs when a lack of information means that economic actors cannot make the decision that provides the most benefit for them – when what is being asked of people is complex and the information that exists is hidden, hard to interpret or there are too many options.

[54] A BEIS report, entitled Electricity Generating Costs 2020 seeks to incorporate and evaluate the wider system impacts from renewable, intermittent generation technologies (eg. wind and solar) - including the transmission network it finds that these technologies impose a wider system cost, which is more severe in scenarios with lower flexibility or a less diverse generation mix. The results from six assessed scenarios highlight that considering wider system impacts changes the cost perception of different technologies.

[55] The majority of which is nuclear (non-dispatchable) and therefore unable, under fluctuating wind conditions, to be used to ramp up and down quickly to provide a constant cumulative output while CCGT, from Peterhead, which is dispatchable and hence is able to increase or decrease output rapidly, is now de-rated to only 400MW, which is not large enough to provide sufficient flexibility to accommodate the variation in wind power output experienced in Scotland.

[56] For instance, the cost of carbon under the existing Emissions Trading System may lead to fossil-fuel generation failing to completely internalise the negative externality. Biomass generation can no longer claim the ‘green’ credentials it once had, but continues to receive a subsidy rather than a penalty. Nuclear brings with it the high cost of security and storage which is treated as a public good - another market failure. Wind, on the other hand, although necessary to mitigate climate change, bears a socio-economic cost, a negative externality, on the communities in whose domain these wind farms and necessary transmission infrastructure are sited as well as reducing the visual amenity of the natural capital of the environment. Transmission losses increase and are unaccounted for and the need for battery storage - to minimise fluctuations in output seen on the network is overlooked in the LCoE calculation.

[57] This refers to storage that is located at or close to the renewable energy site. In this event peak lopping is attractive because can be used as part of the Capacity Market and thereby be entitled to payment - see Mott Macdonald reference.11

12 References

Ambrose, J. (2021) Gone with the wind: why UK firms could miss out on the offshore boom. The Guardian, 4 September 2021.

Crichton, T. (2021) Nicola Sturgeon rules out nuclear power as an alternative to fossil fuels in Scotland. Daily Record, 25 November 2021.

Department for Business, Energy & industrial Strategy (2020) Electricity Generating Costs.

Economics on line www.economicsonline.co.uk

Elexon (2019) The Electricity Trading Arrangements.

Equinor (2020) Powering the UK’s Energy Future.

Field, A. (2013) Discovering statistics using IBM SPSS Statistics. 4th ed. London. Sage Publications Ltd.

Gill, S. and Bell, K. (2017) Meeting Scotland’s peak demand for electricity. ClimateXchange.

Historical wind speed data (2021) www.visualcrossing.com

Grid Watch at www.gridwatch.co.uk

HM Government (2015) Policy Paper: 2010 to 2015 Government policy: low carbon technologies, Appendix 5: the Renewables Obligation.

HM Government (2021) Digest of the UK Energy Statistics (DUKES): electricity.

HM Government (2020) Net Zero Review publishes initial analysis of green transition.

McLeod, N. (2021) HVDC Interconnectors, IET Webinar, 12 October 2021.

Mott Macdonald (2018) Storage costs and technical assumptions: summary document.

National Grid (2020) Electricity Ten Year Statement.

National Grid (2021a) Monthly Balancing Services Summary 2020/21.